GPT Stands for ‘Geopolitical Tension’: How AI raises the Temperature in the Semiconductor Cold War Between the U.S. and China

By Andrew Bruner, Taylor University

On November 30, 2022, Silicon Valley’s OpenAI released Chat-GPT, and within its first five days, the AI chatbot hit over one million users.[1] Not even two years later, the world is still grappling with the massive impact that artificial technologies as a whole promise to have on the near-future, and indeed are already having, in everything as simple as vacation planning to advanced medical applications. Despite what the overwhelming reception of Chat-GPT would suggest, this isn’t the first time an American-made, Silicon Valley-based artificial intelligence model has shocked millions.

In 2016, 280 million Chinese citizens tuned in to watch an artificial intelligence model called “AlphaGo” play the ancient game of go, ultimately triumphing over a world champion player. Few in the U.S. except for tech experts and policy wonks paid much attention to the event, but it caused outrage in China, with some even dubbing it the CCP’s “Sputnik moment” in the AI revolution. Indeed, “What really mattered was that a machine owned by a California company, Alphabet, the parent of Google, had conquered a game invented more than 2,500 years ago in Asia.”[2] And reminiscent of Sputnik’s kicking the U.S. space industry into overdrive, AlphaGo’s victory “cracked the air like a warning shot” in Beijing, triggering massive, state-backed funding initiatives to support AI ventures and the state’s bid to become “the world leader” in AI by 2030.[3] Ever since, the AI race between the U.S. and China has only been accelerating with each new breakthrough, leading the two nations to view one another increasingly as enemies. AI’s “GPT” means “generative pre-trained transformer” to software developers, but to politicians leading the two most powerful nations on earth, it might as well stand for “geopolitical tension,” as it seems poised to continue increasing just that.

Ultimately, this paper is not concerned with whether the U.S.-China AI race is justified. Neither is it concerned with the threats represented by AI itself. The tech Armageddon that Elon Musk and others have prophesied[4] might well happen someday, but for now the jury is still out. In the meantime, this paper will argue that the AI revolution’s immediate economic impact has created new fracture points between the U.S. and China while exacerbating those that already existed. For one, this paper will show how heightened demand for semiconductors—the high-tech chips essential for AI training and algorithms—has put pressure on domestic production, leading to massive capital mobilization. Next, it will trace how the lucrative nature of AI chips has led each government to engage in massive industrial stimulus packages and tit-for-tat export restrictions in attempts to increase productive self-sufficiency. Then, it will argue that while these policies are damaging enough by themselves, the long-term price of economic decoupling, especially in light of China’s present economic situation, may backfire on the U.S. Finally, this essay will discuss the role of Taiwan as a U.S. ally that produces 68% of the world’s AI-critical chips and has been embroiled in independence disputes with China for decades.[5] Taken together, all of the aforementioned factors are evidence of the increased securitization of semiconductors by two leading superpowers, which in turn increases the risk of military escalation between the U.S. and China. While this risk remains low, it has indisputably grown due to AI’s explicit economic effects on geopolitics.

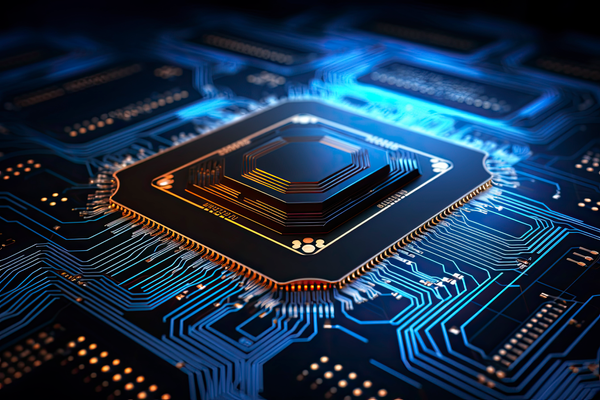

Access to advanced semiconductors has become critical for competitive nations seeking to harness the massive opportunities represented by AI. As such, demand forecasts for the technology have skyrocketed. In November 2023, analysis firm IDC predicted worldwide semiconductor revenue in 2024 would total at $633 billion, seeing year-over-year growth of 20.2%.[6] Beyond this, concern for the military applications of AI and the chips on which it depends has driven Washington and Beijing alike to elevate rhetoric to the national security level. In fact, the securitization of artificial intelligence was a driving force behind Congress passing the 2022 Chips and Science Act, which contains $280 billion in funding and incentives directed at nearshoring semiconductor manufacturing and research over the next several years.[7] The mere agreement of Congress on such a massive spending package during one of the most polarizing sessions in U.S. history[8] points to the depth of conviction on Capitol Hill that China must be countered. Indeed, current policy discussion in Washington around AI is heavily centered on the fear that China will surpass the U.S.[9] Had AI not introduced an entirely new driver of economic competition and military threats, the semiconductor spending war underway between Washington and Beijing might have been avoided.

There is no question that the new AI-economy has mobilized capital—and lots of it. In particular, investors and U.S. tech firms have bet heavily on semiconductors and data centers as the integral technologies behind AI. Key players have recorded record growth, including American tech giant Nvidia, which has seen 400% gains from November 2022 to March 2024.[10] Perhaps even more tellingly of AI’s impact, Nvidia’s “Data Center Processors for Analytics and AI” product line has grown from accounting for 27.3% of its revenues in 2020 to 78.0% of its revenues in 2024, all while the company continues to experience rapid growth in revenue and market capitalization.[11] Nvidia is but one example of how the entire AI market has been supercharged by readily available government funding. A Nvidia-linked partner based in South Korea, SK Hynix, announced in March 2024 that “it plans to invest roughly $4 billion to build an advanced chip-packaging facility in West Lafayette, Indiana,” taking advantage of support from the Chips and Science Act.[12] Indeed, from the legislation’s passage to mid-April 2024, data from the German Marshall Fund suggests that U.S. semiconductor investments announced have totaled at least $370 billion and are projected to create over 200,000 combined direct and indirect jobs.[13] Government stimulus spending had already primed the U.S. semiconductor industry months before Chat-GPT became a household name, but the added demand of AI’s continued growth has mobilized massive amounts of capital and pushed the American tech economy into overdrive.

To American investors, this economic stimulus is incredibly positive news, but to Chinese politicians, it is evidence of increasingly anticompetitive and alarmingly effective industrial policy. Beyond stimulating the U.S. AI-economy, the Chips and Science Act has played a major role in restricting the PRC’s access to advanced AI-related hardware components. A key clause in the act itself stipulates that funding recipients may not expand semiconductor manufacturing in China, as the country is deemed to “pose a threat to US national security.”[14] In addition, the federal government has banned the export of cutting-edge American tech to China, including Nvidia’s A100 and H100 chips, which “feature built-in infrastructure for training AI models and algorithms.”[15] Both of these actions are uncharacteristically insular for a nation that prides itself on competition and free markets, underscoring the immense security threat that Washington perceives in the CCP’s use of high-tech American hardware in its artificial intelligence programs.

The Chips and Science Act has been overwhelmingly successful in generating significant investment for the U.S. semiconductor and closely-linked AI industries, but it is precisely the policy’s success, coupled with significant trade restrictions on exports to China from the U.S. and its allies, that has led the CCP to respond with drastic policy measures of its own. Following the U.S. export controls on chips in October 2022, China filed suit against the U.S. within the World Trade Organization.[16] It has since also restricted the export of its own gallium and germanium, two raw materials vital to semiconductor production.[17] As early as two months after the enactment of the Chips and Science Act, the CCP was rumored to be considering a similar policy of its own, which would have involved subsidies for the Chinese semiconductor industry totaling more than $143 billion.[18] To date, this policy is yet to be enacted, but there are other efforts inside the CCP to stimulate investment. In September 2023, China began preparing to launch a $40 billion state-backed fund for its semiconductor sector in an attempt to achieve greater self-sufficiency.[19]

Despite all of this rampant domestic investment, there is still no guarantee that it will pay off, as China’s domestic semiconductor industry continues to lag significantly behind that of the U.S., due in part to ongoing export restrictions.[20] Indeed, the Biden administration has been successful in convincing U.S. allies to impose anti-China export restrictions of their own. In July 2023, Japan began requiring 23 different chip-manufacturing items to require approval for export.[21] Six months later, the Dutch government restricted the sale of Netherlands-based ASML’s extreme ultraviolet (EUV) lithography machines, which “are critical to manufacturing the most advanced semiconductors.”[22] A Brookings report indicated that “Chinese players remain decades behind in some of the most important [semiconductor] manufacturing technology areas,”[23] and are thus lagging significantly behind U.S. competitors in the AI-economy.

While rational state actors might conclude that a weakened enemy makes them safer, the reality is often more complicated. Sun Tzu famously stated in The Art of War that “The supreme art of war is to subdue the enemy without fighting.” Indeed, it likely appears to the CCP that the U.S. is seeking to do just that, even while Washington might rightly justify its actions as self-protective. The real question is whether China will allow its economy to be subdued without lashing out. Entirely apart from being barred access to the fruits of the AI revolution, China’s economic situation is indeed already dire. The country faces a mounting demographic crisis as citizens have fewer children and the population ages, leaving behind a shrinking workforce. Additionally, China’s debt-to-GDP-ratio has already far exceeded that of the U.S., and foreign portfolio investment has dropped significantly in most quarters since March 2022.[24]

On the one hand, China’s domestic woes might be enough on their own to decrease the risk of military conflict with the U.S., as domestic issues may by necessity take precedence over global and regional goals. However, history is replete with leaders using the rhetoric of the oppressed to justify expansionist land grabs, and China’s Xi Jinping might yet follow their lead. Most recently, Vladimir Putin’s invasion of Ukraine gave the CCP a front row seat to observe the contours of a Western response to all-out war on the fringes of liberal democracy. Despite massive economic and military support for Ukraine and hundreds of damaging sanctions, the Russian economy has stabilized, even over two years into the war.[25] Making matters worse, Washington floundered over sending additional aid to Ukraine, only passing the April 2024 package after months of gridlock in the House.[26] Russia’s persistence, coupled with the West’s faltering collective action and inability to break Putin’s resolve, could be a major factor in giving China the confidence it needs to invade Taiwan—its own independence-seeking next-door neighbor. To be clear, Taiwan is certainly not to China as Ukraine is to Russia. There simply are no perfect parallels in geopolitics. Nevertheless, the allied response (or lack thereof) towards Putin’s aggression might embolden the CCP to pursue a coercive reunification of the island with mainland China.

Taiwan takes center stage in geopolitics not only because of its ongoing quest for independence from China, but because of its role as the largest exporter of semiconductors in the world[27] in the midst of the ongoing AI revolution. China itself imports roughly 60% of Taiwan’s total microchip exports,[28] a fact which also has the potential to decrease the likelihood of a Chinese invasion, since an invasion would almost certainly cause significant damage to infrastructure, including semiconductor foundries. Even if China were able to seize Taiwan with its chip “fabs” mostly intact, it would not be capable of operating them since they “require continued access to U.S. and allied technologies and equipment to function,” which the U.S. would almost certainly refuse to provide in such a case.[29] China’s economic dependence on Taiwan certainly serves as one deterrent to invasion, but there is at least one other major consideration: China’s goal of reunification with Taiwan could outweigh its economic motives, a conviction held by David Sacks of the Council on Foreign Relations.[30] Thus, an invasion might well have little to do with China’s pursuit of Taiwan’s massive semiconductor industry and much more to do with decades-long independence disputes. That said, the same report by Council on Foreign Relations also suggests that a slowing Chinese economy could increase the chances of military conflict in the Taiwan Strait.[31] Other escalations short of invasion, such as interfering with the cargos of trading vessels or initiating a naval blockade[32] are certainly within China’s strategy considerations and may involve a combination of political and economic interests. Even if China can’t access the chips itself, it could at least try to prevent Taiwan from exporting them to Western markets.

It is possible that China could gain in the AI-economy from even a full-scale invasion of Taiwan. China is reliant on Taiwan for chip imports, but the U.S. holds significant influence over major manufacturer TSMC, who since opting receiving federal support from the Chips and Science Act has legally bound itself, like U.S. manufacturer Intel, from adding any new chip fabs in China.[33] Thus, a partial motive for invasion could come from China’s desire to wrest total control over TSMC. This may seem far-fetched, but the CCP’s current outrage over what it perceives as a U.S. hostile takeover of social media platform TikTok, which is owned by the Chinese company ByteDance, could prompt it to consider something similar,[34] especially when the stakes are even higher with TSMC. Perhaps most convincingly, invasion could be appealing to China because even if 80% of Taiwan’s semiconductor production fabs were destroyed in the process, China could operate the remaining 20%. That would add overnight to China’s semiconductor production capacity an amount equivalent to that of the entire U.S.[35]

The full extent of the AI-economy’s explosive boom into geopolitics remains to be seen. What is already abundantly clear, however, is that for all its promised benefits, artificial intelligence’s economic impacts continue to have an overwhelmingly negative effect on the U.S.-Sino relationship. AI’s mere existence has elevated economic competition into a new level of technological and tactical importance. Capital mobilization and domestic industrial policy in the U.S. may serve national security interests in the near term, but they have the unfortunate side-effect of increasing the rate of economic decoupling between the U.S. and China. This, in turn, carries the increased risk of military escalation between China and Taiwan. In summary, the trickle-down economic effects of AI have significant implications for U.S.-China relations and global stability, as they increase the likelihood of conflict between the world’s two greatest powers.[36]

The author would like to acknowledge the collaborative support, expertise, and advice of Dr. Jakob Miller, Associate Professor of Political Science at Taylor University, without whom this research project would not have come to fruition.

[1] Marr, Bernard. “A Short History of ChatGPT: How We Got to Where We Are Today.” Forbes, February 20, 2024. https://www.forbes.com/sites/bernardmarr/2023/05/19/a-short-history-of-chatgpt-how-we-got-to-where-we-are-today/?sh=79ed9ce2674f.

[2] Thompson, Nicholas. “The AI Cold War That Threatens Us All.” Wired, October 23, 2018. https://www.wired.com/story/ai-cold-war-china-could-doom-us-all/.

[3] Marr, Bernard. “A Short History of ChatGPT: How We Got to Where We Are Today.” Forbes, February 20, 2024. https://www.forbes.com/sites/bernardmarr/2023/05/19/a-short-history-of-chatgpt-how-we-got-to-where-we-are-today/?sh=79ed9ce2674f; Mozur, Paul. “Beijing Wants A.I. to Be Made in China by 2030.” The New York Times, July 20, 2017. https://www.nytimes.com/2017/07/20/business/china-artificial-intelligence.html.

[4] Metz, Cade, and Gregory Schmidt. “Elon Musk and Others Call for Pause on A.I., Citing ‘Profound Risks to Society.’” The New York Times, March 29, 2023. https://www.nytimes.com/2023/03/29/technology/ai-artificial-intelligence-musk-risks.html.

[5] Chiang, Sheila. “Taiwan Plays a ‘very Crucial Role’ in AI Supply Chain, Says Taiwan Stock Exchange CEO.” CNBC, April 19, 2024. https://www.cnbc.com/2024/04/19/taiwan-plays-very-crucial-role-in-ai-supply-chain-says-twse-chief.html.

[6] “Worldwide Semiconductor Market Outlook Upgraded to Growth from Trough: Semiconductor Market to Grow 20.2% in 2024 to $633 Billion, According to IDC.” IDC Research, November 14, 2023.

[7] Edmondson, Catie. “Senate Passes $280 Billion Industrial Policy Bill to Counter China.” The New York Times, July 27, 2022. https://www.nytimes.com/2022/07/27/us/politics/senate-chips-china.html.

[8] DeSilver, Drew. “The Polarization in Today’s Congress Has Roots That Go Back Decades.” Pew Research Center, March 10, 2022. https://www.pewresearch.org/short-reads/2022/03/10/the-polarization-in-todays-congress-has-roots-that-go-back-decades/.

[9] Cuéllar, Mariano-Florentino, and Matt Sheehan. “Ai Is Winning the AI Race.” Foreign Policy, June 20, 2023. https://foreignpolicy.com/2023/06/19/us-china-ai-race-regulation-artificial-intelligence/.

[10] Nvidia Corporation (NVDA) stock price, news, Quote & History - Yahoo Finance. Accessed May 1, 2024. https://finance.yahoo.com/quote/NVDA/.

[11] Lu, Marcus. “Visualizing Nvidia’s Revenue, by Product Line (2019-2024).” Edited by Dorothy Neufeld. Visual Capitalist, April 1, 2024. https://www.visualcapitalist.com/nvidia-revenue-by-product-line/; [11] Nvidia Corporation - Nvidia announces financial results for fourth quarter and fiscal 2024, February 21, 2024. https://investor.nvidia.com/news/press-release-details/2024/NVIDIA-Announces-Financial-Results-for-Fourth-Quarter-and-Fiscal-2024/.

[12] Sohn, Jiyoung, and John Keilman. “Nvidia Partner Plans $4 Billion Investment in Indiana.” The Wall Street Journal, March 26, 2024. https://www.wsj.com/tech/nvidia-partner-plans-4-billion-investment-in-indiana-4a094ace.

[13] “The GMF Digital Semiconductor Investment Tracker.” German Marshall Fund. Accessed May 1, 2024. https://www.gmfus.org/gmf-digital-semiconductor-investment-tracker.

[14] PricewaterhouseCoopers. “The Chips Act: What It Means for the Semiconductor Ecosystem.” PwC. Accessed May 1, 2024. https://www.pwc.com/us/en/library/chips-act.html.

[15] Shivakumar, Sujai, Charles Wessner, and Thomas Howell. “Balancing the Ledger: Export Controls on U.S. Chip Technology to China.” CSIS, February 21, 2024. https://www.csis.org/analysis/balancing-ledger-export-controls-us-chip-technology-china.

[16] Allen, Gregory C. “China’s New Strategy for Waging the Microchip Tech War.” CSIS, May 3, 2023. https://www.csis.org/analysis/chinas-new-strategy-waging-microchip-tech-war.

[17] “China Export Curbs Choke off Shipments of Gallium, Germanium for Second Month.” Reuters, October 19, 2023. https://www.reuters.com/world/china/china-export-curbs-choke-off-shipments-gallium-germanium-second-month-2023-10-20/.

[18] Zhu, Julie. “China Readying $143 Billion Package for Its Chip Firms in Face of U.S. Curbs.” Reuters, December 13, 2022. https://www.reuters.com/technology/china-plans-over-143-bln-push-boost-domestic-chips-compete-with-us-sources-2022-12-13/.

[19] Zhu, Julie, Kevin Huang, Yelin Mo, and Roxanne Liu. “China to Launch $40 Billion State Fund to Boost Chip Industry.” Reuters, September 5, 2023. https://www.reuters.com/technology/china-launch-new-40-bln-state-fund-boost-chip-industry-sources-say-2023-09-05/.

[20] Thomas, Christopher. “Lagging but Motivated: The State of China’s Semiconductor Industry.” Brookings, January 7, 2021. https://www.brookings.edu/articles/lagging-but-motivated-the-state-of-chinas-semiconductor-industry/.

[21] Kharpal, Arjun. “ASML Blocked from Shipping Some of Its Critical Chipmaking Tools to China.” CNBC, January 2, 2024. https://www.cnbc.com/2024/01/02/asml-blocked-from-exporting-some-critical-chipmaking-tools-to-china.html.

[22] “Japan’s Export Curbs on Chip-Making Equipment to China Take Effect.” The Japan Times, July 23, 2023. https://www.japantimes.co.jp/news/2023/07/23/business/chip-export-curbs-begin/.

[23] Douglas, Jason. “What’s Wrong with China’s Economy, in Eight Charts.” The Wall Street Journal, March 1, 2024. https://www.wsj.com/world/china/whats-wrong-with-chinas-economy-in-eight-charts-efc2ea5f.

[24] “Japan’s Export Curbs on Chip-Making Equipment to China Take Effect.” The Japan Times, July 23, 2023. https://www.japantimes.co.jp/news/2023/07/23/business/chip-export-curbs-begin/.

[25] Prokopenko, Alexandra. “Is the Kremlin Overconfident about Russia’s Economic Stability?” Carnegie Endowment for International Peace, April 10, 2024. https://carnegieendowment.org/2024/04/10/is-kremlin-overconfident-about-russia-s-economic-stability-pub-92174; Mascaro, Lisa. “Seeking ‘the Right Side of History,’ Speaker Mike Johnson Risks His Job to Deliver Aid to Ukraine.” AP News, April 19, 2024. https://apnews.com/article/house-ukraine-aid-speaker-ouster-c525efc953d532242d6d441c55724992.

[26] Mascaro, Lisa. “Seeking ‘the Right Side of History,’ Speaker Mike Johnson Risks His Job to Deliver Aid to Ukraine.” AP News, April 19, 2024. https://apnews.com/article/house-ukraine-aid-speaker-ouster-c525efc953d532242d6d441c55724992.

[27] “Taiwan’s Dominance of the Chip Industry Makes It More Important.” The Economist, March 6, 2023. https://www.economist.com/special-report/2023/03/06/taiwans-dominance-of-the-chip-industry-makes-it-more-important.

[28] Blanchette, Jude, and Gerard DiPippo. “‘reunification’ with Taiwan through Force Would Be a Pyrrhic Victory for China.” CSIS, November 22, 2022. https://www.csis.org/analysis/reunification-taiwan-through-force-would-be-pyrrhic-victory-china.

[29] Sacks, David. “Will China’s Reliance on Taiwanese Chips Prevent a War?” Council on Foreign Relations, July 6, 2023. https://www.cfr.org/blog/will-chinas-reliance-taiwanese-chips-prevent-war.

[30] Blanchette, Jude, and Gerard DiPippo. “‘reunification’ with Taiwan through Force Would Be a Pyrrhic Victory for China.” CSIS, November 22, 2022. https://www.csis.org/analysis/reunification-taiwan-through-force-would-be-pyrrhic-victory-china.

[31] Collins, Gabriel, and Andrew Erickson. “Silicon Hegemon: Could China Take over Taiwan’s Semiconductor Industry without Invading?” Baker Institute, September 27, 2023. https://www.bakerinstitute.org/research/silicon-hegemon-could-china-take-over-taiwans-semiconductor-industry-without-invading.

[32] Sacks, David. “Will China’s Reliance on Taiwanese Chips Prevent a War?” Council on Foreign Relations, July 6, 2023. https://www.cfr.org/blog/will-chinas-reliance-taiwanese-chips-prevent-war.

[33] Wu, Debby, Daniel Flatley, and Jenny Leonard. “US to Stop TSMC, Intel from More Advanced Chip Production in China.” Bloomberg.com, August 2, 2022. https://www.bloomberg.com/news/articles/2022-08-02/us-to-stop-tsmc-intel-from-adding-advanced-chip-fabs-in-china.

[34] Tobin, Meaghan. “China Condemns U.S. Proposal to Force the Sale of TikTok.” The New York Times, March 13, 2024. https://www.nytimes.com/2024/03/13/business/china-tiktok-congress.html.

[35] Varas, Antonio, Raj Varadarajan, Jimmy Goodrich, and Falan Yinug. “Government Incentives and US Competitiveness in Semiconductor Manufacturing.” Semiconductor Industry Association, September 2020. https://www.semiconductors.org/turning-the-tide-for-semiconductor-manufacturing-in-the-u-s/.